Everyone keeps talking about “the new normal,” but no one knows what it means. As we start venturing back out into the world and the workplace, we know things will be changed, but how much — and for how long?

The 400+ employers we surveyed in early June gave us some answers. In short, big changes are coming for benefits, enrollment and the workplace. And they could be permanent.

Highlights

- Employers get the message on paid leave. It took a pandemic to make it happen, but U.S. employers are waking up to employees’ need for leave benefit strategies that reflect reality. Almost half (44%) say they will likely expand paid leave benefits next year. Only a quarter say they won't.

- Work-from-home taboos dissolve. Businesses that were able to transition to remote work are taking baby steps to bring people back to the workplace. But employers appear to have learned that people can still be productive working from home, and more than half (56%) plan to give employees more flexibility in the future.

- Enrollment meets social distancing. If there’s one thing everyone learned from lockdown, it’s how to accomplish things remotely. Employers are taking that lesson and applying it to benefits enrollment, with virtual meetings trending sharply upward over last year.

- Benefits pulled in opposite directions. On the one hand, COVID-19 shone a bright light on employees’ need for benefits. On the other, there’s now a recession. More than half (57%) of survey respondents plan to change their benefits package next year. Many plan to expand benefits, especially wellness benefits — many others plan to make cuts.

Take our weekly poll

Will you expand paid leave benefits in the next 12 months?

Employers get the paid-leave message

As the COVID-19 pandemic hit the U.S. in the spring of 2020, people without paid sick leave wondered how they would cope if they got sick. At the same time, schools and daycares closed, sending children home to be supervised by parents who had to go to work.

Faced with the prospect of millions of people potentially losing their incomes, their jobs, or even their homes, Congress responded by requiring employers with fewer than 500 employees to provide some paid leave to employees who were sick or diagnosed with COVID-19, or taking care of children who were suddenly home all day.

The employers we surveyed seem to understand that the need for leave will continue beyond December 31, when the Congressional mandate ends. Nearly half say they will likely be expanding their paid leave offerings in the next year as a result of the pandemic. Only about a quarter said they probably or definitely will not.

Work from home: No longer taboo

In 2020, you had to live under a rock to escape jokes and complaints about video meetings. Nearly all (95%) of employers in our survey transitioned at least one person to working from home. On average, 60% of employees at these businesses had worked remotely due to the pandemic, echoing a similar finding in a recent Gallup poll.

By the time our survey was conducted though, remote workers had peeked outside and begun to tiptoe back to their offices and worksites. The vast majority of businesses were bringing people back gradually. At the time of our survey, almost three-quarters of employers had half or fewer of their workers back on site.

That’s because they are still worried about bringing people back safely, according to survey responses. They don’t want their worksite to be the place where the virus gets transmitted and their employees get sick. They know they need to take precautions like social distancing, cleaning and having employees wear facial coverings, but some wonder if employees will follow these practices or if they will even be effective.

Work from home

95% of employers had at least one person working from home during the pandemic

On average, 60% of an organization's employees were working from home

Employees are gradually returning to work

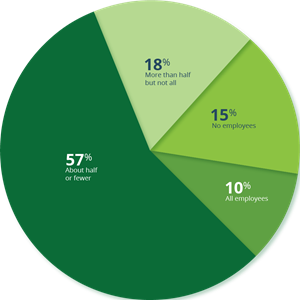

Percentage of employers reporting their employees have returned back on site:

10% all employees

18% more than half but not all

57% about half or fewer

15% no employees

Thinking only about the employees who transitioned to working from home due to the COVID-19 situation, about how many of these employees have now come back to the workplace (e.g. office, facility, store) as social distancing guidelines have eased? Please select the one that best describes your situation.

Despite technology snags and meetings in pajamas, many employers appear to have lost their phobia of allowing people to work from home. Maybe this is because productivity may have actually increased, maybe because they have invested heavily in remote capabilities, maybe because they want to be prepared for a virus resurgence in the future.

Whatever the reason, a surprising 56% of employers said they’d allow employees flexibility to work from home even after the pandemic crisis ends. Less than 20% said they would not, including (unsurprisingly) many retail businesses and other businesses with hourly-wage employees.

Will you allow employees the flexibility to work from home even after the COVID-19 pandemic is over?

56% Yes

26% Not sure yet

17% No

Virtual enrollment trends up

While most of us were social distancing, we learned to do new things virtually: educate children, meet up with friends, even go to the doctor. Why should benefits enrollment be any different? Compared to last year, fewer employers are planning to use in-person meetings to conduct benefits enrollment, while use of virtual video conferencing is likely to nearly double, according to reports from employers.

The convenience of virtual enrollments, increased through necessity, may well have more employers continuing on this path even after the pandemic recedes.

Virtual enrollment replacing face-to-face

Year-over-year changes for enrollment methods for medical and non-medical benefits

Dual reality for benefits

The pandemic has illuminated the need for benefits to help when things get complicated. Employees who got sick with COVID-19 needed health care coverage and disability benefits to help pay the bills while they recovered. But at the same time, the sagging economy has put the squeeze on business revenues.

Employers are split in their reactions to these competing priorities, and the majority said they were planning to make one or more changes to their non-medical benefits packages next year.

Some employers are planning to enhance their programs, either by adding new benefits or paying a greater portion of the cost. Nearly a third said they’re planning to expand wellness benefits to support their employees’ physical and mental well-being.

Still, some said they’d have to reduce benefits — or shift more of the cost onto employees.

What non-medical benefit changes will you make for 2021?

What's next

Clearly, the pandemic has forced employers to look more closely at how they support employees’ health and wellness, and how to remain competitive in the months and years to come.

The months in lockdown and the planning for a safe return to work have surfaced employees’ need to care for others and to stay physically and mentally healthy themselves. Many employers are responding with increased benefits and flexibility for workers. In the new, remote reality, virtual and online methods of working will be essential.

But employers need to be aware that increasing work from home will increase the war for talent, as well. When people can work anywhere, their choice of employers is virtually unlimited. To compete, employers will need to revisit their benefits offerings, even if the economy is slow to recover.

About the survey

We surveyed 407 employers from June 11 to June 16, 2020, with roughly 100 responses coming from employers in each of four employee-size categories: 1 to 99, 100 to 499, 500 to 1,999 and 2,000+. Respondents were limited to persons involved in employee benefits decision-making or administration at U.S.-based organizations representing a wide variety of industries.

Read the Unum April 2020 Employer Insights Survey: How companies have responded to the COVID-19 crisis.

About Unum

At Unum, we help the working world thrive throughout life’s moments. We help millions of people gain affordable access to disability, life, accident, critical illness, dental and vision benefits through the workplace — benefits that help them protect their families, their finances and their futures.

Leave and absence management

Introducing Unum Total Leave™

Total Leave helps streamline absence management for HR while making leave easy and accessible for employees.

Reference material

Figure 1: Percentage of employers reporting their employees have returned back on site [Back to figure]

Q: Has your organization taken or is it planning to take any of the following actions to reduce employment costs due to the economic downturn related to the COVID-19 pandemic?

| All employees | More than half but not all | About half or fewer | No employees |

|---|---|---|---|

| 26% | 18% | 57% | 15% |

Figure 2: Year-over-year changes for enrollment methods for medical and non-medical benefits [Back to figure]

Q: Now thinking about benefits enrollment, what method(s) is your organization planning to use this year for employees to select their medical and non-medical benefits? What method(s) of enrollment did your organization use last year for employees to select their medical and non-medical benefits?

| Benefit enrollment method | 2019 | 2020 |

|---|---|---|

| In-person meeting with benefits counselor | 49% | 33% |

| Virtual video conference or co-browsing with benefits counselor | 23% | 42% |

| Online self-guided | 47% | 54% |

| Telephone | 24% | 22% |

| Paper | 26% | 20% |

| No enrollment | 2% | 7% |

Figure 3: What non-medical benefit changes will you make for 2021? [Back to figure]

Given what you know about the impact of COVID-19 pandemic on businesses and workers, which of the following changes specific to the non-medical insurance benefits offered to employees in your organization considering in the next 12 months?

| Percentage of respondents | |

|---|---|

| No expected changes | 43% |

| Changes expected | 57% |

| Expected changes in benefit breakdown | |

| Add new/expand wellness benefits | 31% |

| Shift more of benefits cost to employers | 15% |

| Add new/expand employer-paid benefits | 3% |

| Add new/expand employee-paid benefits | 2% |

| Shift more of benefits cost to employees | 20% |

| Reduce employer-paid coverage levels | 18% |

| Drop one or more employer-paid benefit | 10% |